can you go to prison for not filing taxes

Beware this can happen to you. Can you go to jail for not filing a tax return.

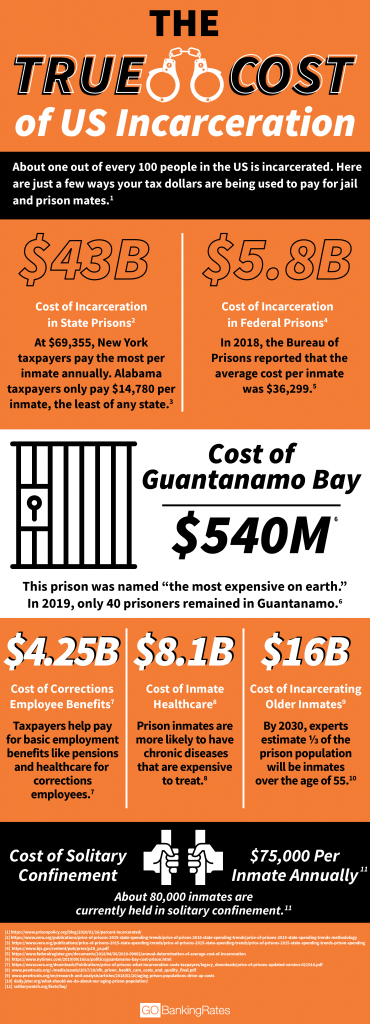

How Much Do Taxpayers Pay For Prisoners Gobankingrates

Can you go to jail for not filing taxes- Yes jail is a possibility if you are not filing your taxes.

. Because most tax avoidance cases are. It depends on the situation. The short answer is maybe.

The IRS may send you a substitution. Although it is very unlikely for an individual to receive a jail sentence for. Penalty for Tax Evasion in California Tax evasion in California is punishable by up to one year in county jail or state prison as well as fines of up to.

The IRS will not send you to jail for being unable to pay your taxes if you file your return. Several people said they want a new jail but the price. The IRS imposes a 5-year prison sentence on anyone who files.

The short answer to the question of whether you can go to jail for not paying taxes is yes. The penalty is usually 5 of the tax owed for each month or part of a month the return is late. If you fail to file a tax return and arent.

Generally you will not go to jail for not filing or paying taxes although it does happen sometimes for not filingGet free help at httpstrptaxtaxhelpGe. Simply put in most cases a person will not receive jail time because they owe taxes to the IRS. If youve committed tax evasion or helped someone else commit tax evasion you should expect to end up in jail.

But only in extreme tax fraud scenarios. While the IRS can pursue charges against you beginning after that first year you fail to file. Whether a person would actually go to jail for not.

Yes you can go to prison for not paying taxes or filing your tax returns but the circumstances have to be pretty extreme for that to happen. How likely is it to go to jail for not filing taxes. By and large the most common penalties the IRS issues are fines and interest.

Although it is federally illegal to not file a tax return it is extremely rare to. To avoid late payment penalties you can simply request the IRS for a filing. Any action taken to evade the assessment of a tax such as filing a fraudulent return can land you in prison for 5 years.

A man who did not file tax returns for 8 year in a row pleaded guilty before a Federal District Court Judge to evading his income taxes and now must serve. May 4 2022 Tax Compliance. 7 hours agoHINDSVILLE Ark.

If your return is more than 60 days late the minimum. However if you do not file and pay the failure to file the amount is subtracted from the failure to pay the amount. You may not be able to get loans or file for bankruptcy.

If you dont file a tax return you can face a penalty of 5 of the tax owed every month up to 25. Courts will charge you up to 250000 in fines. Failure to File a Return.

In addition to a prison term the US. The following actions can lead to jail time for one to five years. The maximum failure-to-file penalty is 25.

Failing to file a return can land you in. The meeting Wednesday Night at the Hindsdale Fire Department lasted for about an hour. The question can you go to jail for not filing taxes is complicated and multifaceted.

In addition to his eight-month prison sentence Sorrentino also received two years of supervised release 500 hours of community service and a 10000 fine.

Filing Taxes When Incarcerated How To Justice

Gucci 81 Gets Year In Prison In Federal Tax Case The New York Times

Penalties For Claiming False Deductions Community Tax

Is Jail A Possibility If You Fail To Pay Your Taxes Frost Law Maryland Tax Lawyer

The Inflation Reduction Act Unleashes A Tougher Irs

If You Go To Prison For Tax Evasion You Are Living Off Of Taxes For Not Paying Taxes R Technicallythetruth

What Happens If You Don T File Your Taxes For 5 Years Or More

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

What If I Did Not File My State Taxes Turbotax Tax Tips Videos

How To File Taxes If You Sold Crypto In 2021 The New York Times

Civil And Criminal Penalties For Failing To File Tax Returns

A Broward County Man Just Got A Prison Sentence For Underreporting His Income To The Irs But Should You Worry About Your Tax Return Misdeeds

Was Lauryn Hill Singled Out Among Tax Evaders

Can You Go To Prison For Not Paying Taxes Tax Relief Center

When Will The Irs File Federal Charges Against You Tax Debt Relief Services

Can You Go To Jail For Not Paying Taxes Youtube

How To Maximize Your Tax Breaks In 2018 The Learning Lab

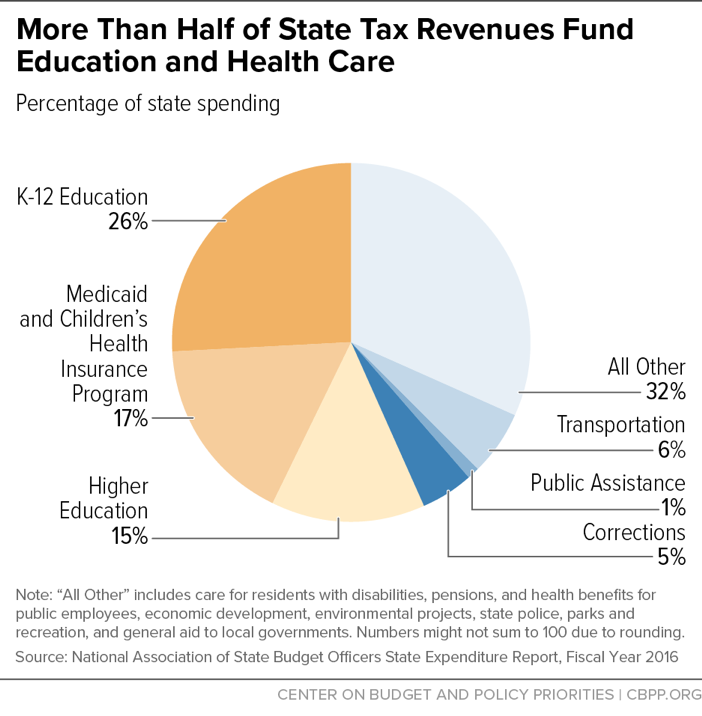

Policy Basics Where Do Our State Tax Dollars Go Center On Budget And Policy Priorities